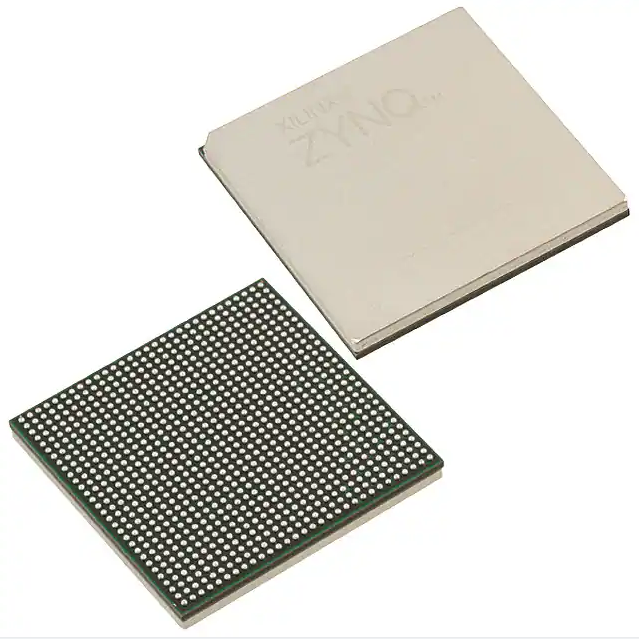

New Original XC7Z010-2CLG225I Inventory Spot Ic Chip Integrated Circuits IC SOC CORTEX-A9 766MHZ 225BGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)Embedded |

| Mfr | AMD Xilinx |

| Series | Zynq®-7000 |

| Package | Tray |

| Standard Package | 160 |

| Product Status | Active |

| Architecture | MCU, FPGA |

| Core Processor | Dual ARM® Cortex®-A9 MPCore™ with CoreSight™ |

| Flash Size | - |

| RAM Size | 256KB |

| Peripherals | DMA |

| Connectivity | CANbus, EBI/EMI, Ethernet, I²C, MMC/SD/SDIO, SPI, UART/USART, USB OTG |

| Speed | 766MHz |

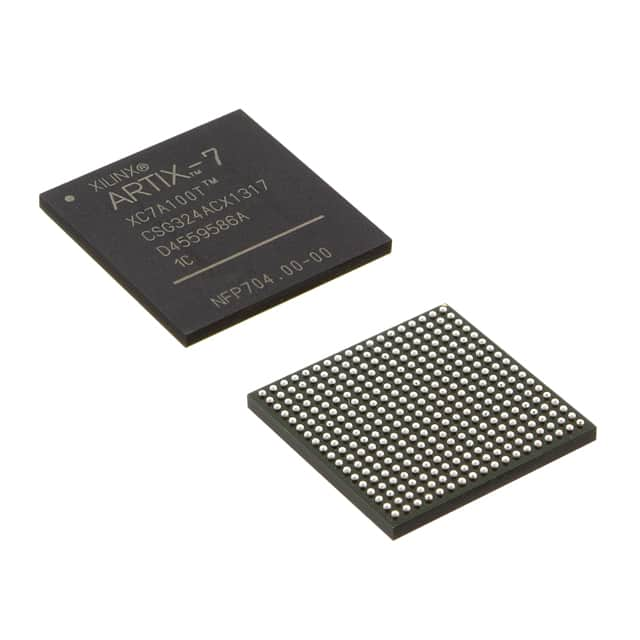

| Primary Attributes | Artix™-7 FPGA, 28K Logic Cells |

| Operating Temperature | -40°C ~ 100°C (TJ) |

| Package / Case | 225-LFBGA, CSPBGA |

| Supplier Device Package | 225-CSPBGA (13×13) |

| Number of I/O | 86 |

| Base Product Number | XC7Z010 |

There is no doubt that in the future, the logo of Celeris, the number one FPGA vendor, will become AMD. Just as Intel faded its brand out of the industry after acquiring Altera, Celeris will also fade out of the industry in the future.

In 1984, Celeris co-founder Ross Freeman invented the FPGA, which opened a new door for the industry. Over the past 38 years, the application area of FPGA has been expanding, becoming an indispensable key device for IC verification, aerospace, communication, automotive, data center, and industrial fields. With the acquisition of global independent FPGA vendors such as Celeris, Altera, and Actel, the development of independent FPGAs seems to have entered a downturn. One era is over, and another is opening.

Top 10 Global IC Designers in 2022Q2: Qualcomm Stands First, AMD Revenue Rises 70% Year-on-Year to Third, Synaptics Returns to Top 10

September 7, 2012 – According to the latest statistical report released by TrendForce, the top 10 global IC design companies’ revenue reached US$39.56 billion in the second quarter of 2022, an annual increase of 32%, with growth mainly driven by demand from data centers, Netcom, IoT, and high-end product portfolios. Among them, AMD benefited from the synergies brought about by the completion of its acquisition of Xilinx, with revenue increasing by 70% year-on-year, making it the highest revenue growth vendor in the second quarter and moving up to third place in the ranking.

In terms of specific rankings, Qualcomm continued to hold the number one position in the world with revenue of US$9.38 billion in the second quarter, up 45% year-on-year, thanks to growth in its mobile, RF front-end, automotive, and IoT divisions. While sales of APs for mid- and low-end handsets were weak, demand for APs for high-end handsets was relatively solid.

In second place was Qualcomm, with total revenue of US$7.09 billion, up 21% year-on-year. Thanks to the expanded adoption of GPUs in data centers, its revenue share has increased to 53.5%, somewhat compensating for a 13% year-on-year decline in the gaming business.

AMD’s revenue grew by 70% year-on-year to US$6.55 billion, following synergies from the completion of the Xilinx and Pensando acquisitions, making it the highest revenue growth vendor in the second quarter and improving its ranking to third place. Specifically, AMD’s embedded division saw revenue growth of 2,228% year-on-year in the second quarter, with another considerable contribution from the data center division.

Broadcom’s (Broadcom) sales performance in semiconductor solutions remained solid, with fairly strong demand for cloud services, data centers, and NetCom, and backlogs of orders still growing, with revenue reaching US$6.49 billion in the quarter, up 31% year-on-year, and ranking fourth.

As for Taiwanese IC designers, MediaTek’s mobile phone, smart device platform, and power management chips all maintained growth, but revenue reached US$5.29 billion, slowing to 18% year-on-year due to sluggish sales of mobile phones from mainland brands.

Display driver chip maker Novatek’s revenue declined to US$1.07 billion in the second quarter, down 12% year-on-year, due to the decline in demand for display panels and consumer terminals, making it the only player among the top 10 to see a year-on-year decline.

Realtek’s revenue declined to US$1.04 billion, slowing to 12 percent year-on-year, due to good performance in its Netcom product portfolio and stable demand for Wi-Fi, although it was still affected by weakness in the consumer and computer markets.

In addition, Marvell’s data center product expansion was successful, with revenue increasing quarter-on-quarter for the ninth consecutive quarter, reaching US$1.49 billion in the quarter, up 50% year-on-year.

Will Semiconductor’s semiconductor design business, which accounts for 80% of CIS revenue and 44% of smartphone applications, saw its total revenue decline to US$690 million, down 16% year-on-year, due to the epidemic and poor demand in the mobile phone market.

Synaptics returned to 10th place after a few quarters. In addition to the contribution from the completion of the DSP Group acquisition, the company focused on the development of its automotive TDDI, Wireless Devices, VR, Video Interface, and other high-end product portfolios, resulting in a 70% share of IoT revenue, which reached US$480 million, up 45% year-on-year. Revenue reached US$480 million, up 45% year-on-year.

According to TrendForce, although most IC design companies were able to maintain annual revenue growth in the second quarter, growth slowed significantly due to general economic uncertainty and poor consumer electronics market conditions, and high inventories gradually built up. As we enter the second half of 2022, downstream inventories have yet to be effectively eliminated. This will be a challenge for the IC design industry.