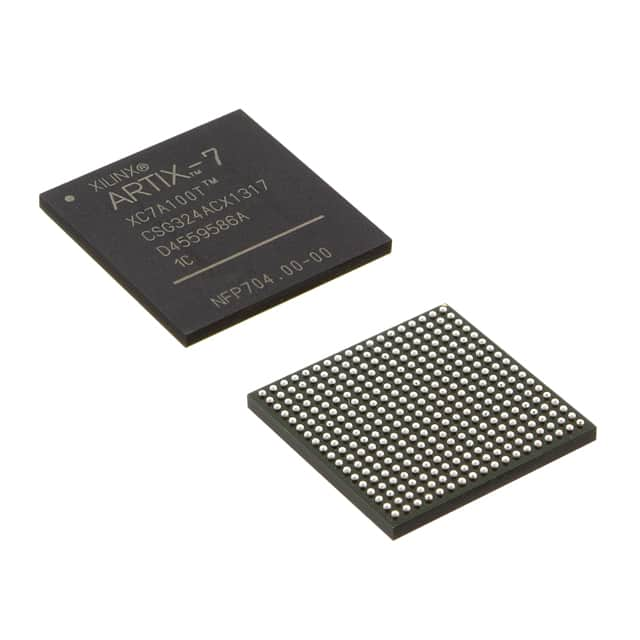

Electronic Components IC Chips Integrated Circuits XC5VFX100T-1FFG1136I IC FPGA 640 I/O 1136FCBGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)EmbeddedFPGAs (Field Programmable Gate Array) |

| Mfr | AMD Xilinx |

| Series | Virtex®-5 FXT |

| Package | Tray |

| Standard Package | 1 |

| Product Status | Active |

| Number of LABs/CLBs | 8000 |

| Number of Logic Elements/Cells | 102400 |

| Total RAM Bits | 8404992 |

| Number of I/O | 640 |

| Voltage – Supply | 0.95V ~ 1.05V |

| Mounting Type | Surface Mount |

| Operating Temperature | -40°C ~ 100°C (TJ) |

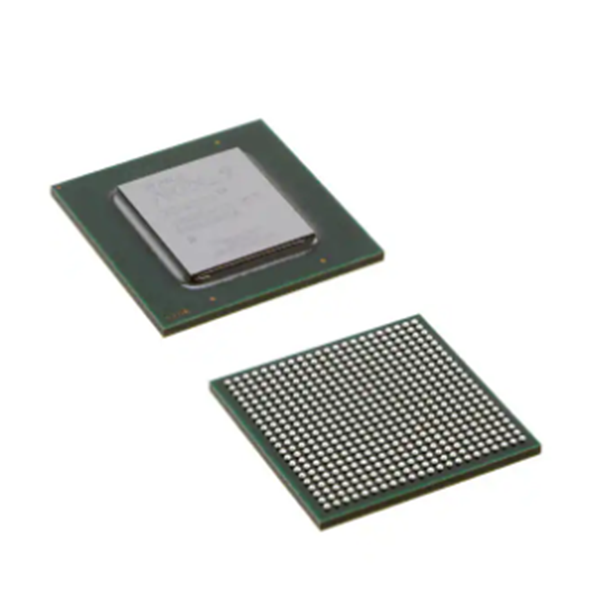

| Package / Case | 1136-BBGA, FCBGA |

| Supplier Device Package | 1136-FCBGA (35×35) |

| Base Product Number | XC5VFX100 |

Xilinx: automotive chip supply crisis is not just about semiconductors

According to media reports, US chipmaker Xilinx has warned that the supply problems affecting the automotive industry will not be resolved soon and that it is no longer just a matter of semiconductor manufacturing but also involves other suppliers of materials and components.

Victor Peng, president, and CEO of Xilinx said in an interview: “It’s not just the foundry wafers that are having problems, the substrates that package the chips are also facing challenges. Now there are some challenges with other independent components as well.” Ceres is a key supplier to automakers such as Subaru and Daimler.

Peng said he hoped the shortage would not last a full year and that Ceres was doing its best to meet customer demand. “We are in close communication with our customers to understand their needs. I think we are doing a good job of meeting their priority needs. Ceres is also working closely with suppliers to solve problems, including TSMC.”

Global car manufacturers are facing huge challenges in production due to the lack of cores. The chips are usually supplied by companies such as NXP, Infineon, Renesas, and STMicroelectronics.

Chip manufacturing involves a long supply chain, from design and manufacturing to packaging and testing, and finally delivery to car factories. While the industry has acknowledged that there is a shortage of chips, other bottlenecks are beginning to emerge.

Substrate materials such as ABF (Ajinomoto build-up film) substrates, which are critical for packaging high-end chips used in cars, servers, and base stations, are said to be facing shortages. Several people familiar with the situation said the ABF substrate delivery time has been extended to more than 30 weeks.

A chip supply chain executive said: “Chips for artificial intelligence and 5G interconnects need to consume a lot of ABF, and demand in these areas is already very strong. The rebound in demand for automotive chips has tightened the supply of ABF. ABF suppliers are expanding capacity, but still can’t meet demand.”

Peng said that despite the unprecedented supply shortage, Ceres will not raise chip prices with its peers at this time. In December last year, STMicroelectronics informed customers that it would increase prices from January, saying that “the rebound in demand after the summer was too sudden and the speed of the rebound has put the entire supply chain under pressure.” On February 2, NXP told investors that some suppliers had already increased prices and the company would have to pass on the increased costs, hinting at an imminent price increase. Renesas also told customers that they would need to accept higher prices.

As the world’s largest developer of field-programmable gate arrays (FPGAs), Ceres’ chips are important for the future of connected and self-driving cars and advanced assisted driving systems. Its programmable chips are also widely used in satellites, chip design, aerospace, data center servers, 4G and 5G base stations, as well as in artificial intelligence computing and advanced F-35 fighter jets.

Peng said all of Ceres’ advanced chips are produced by TSMC and the company will continue to work with TSMC on chips as long as TSMC maintains its industry leadership position. Last year, TSMC announced a $12 billion plan to build a factory in the US as the country looks to move critical military chip production back to US soil. Celerity’s more mature products are supplied by UMC and Samsung in South Korea.

Peng believes that the entire semiconductor industry will likely grow more in 2021 than in 2020, but a resurgence of the epidemic and shortages of components also create uncertainty about its future. According to Ceres’ annual report, China has replaced the US as its largest market since 2019, with nearly 29% of its business.