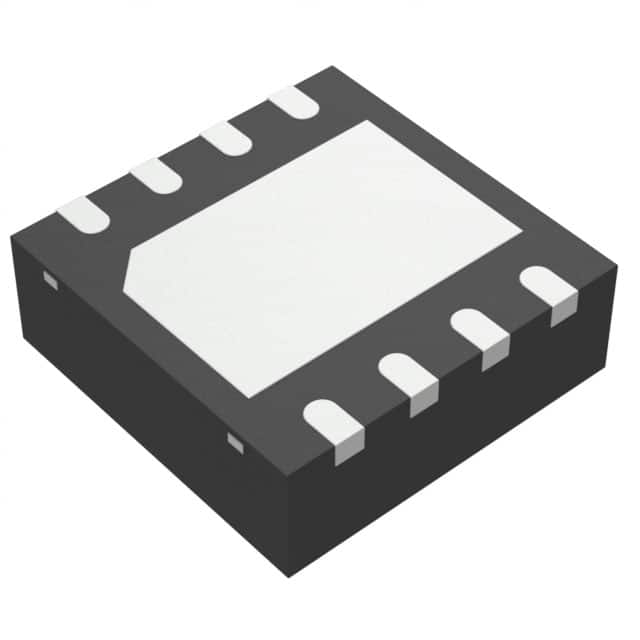

LTC3418EUHF Integrated Circuit New and Original IC REG BUCK ADJUSTABLE 8A 38QFN

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)Power Management (PMIC)Voltage Regulators – DC DC Switching Regulators |

| Mfr | Analog Devices Inc. |

| Series | - |

|

|

Tube |

| Product Status | Obsolete |

| Standard Packaging | 52 |

| Function | Step-Down |

| Output Configuration | Positive |

| Topology | Buck |

| Output Type | Adjustable |

| Number of Outputs | 1 |

| Voltage – Input (Min) | 2.25V |

| Voltage – Input (Max) | 5.5V |

| Voltage – Output (Min/Fixed) | 0.8V |

| Voltage – Output (Max) | 5V |

| Current – Output | 8A |

| Frequency – Switching | 1MHz |

| Synchronous Rectifier | Yes |

| Operating Temperature | -40°C ~ 85°C |

| Mounting Type | Surface Mount |

| Package / Case | 38-WFQFN Exposed Pad |

| Supplier Device Package | 38-QFN (5×7) |

Among the top ten analog chip companies, Texas Instruments was the first to manufacture integrated circuits and was a leader in two areas, power management, and operational amplifiers, with downstream markets concentrated in industrial and automotive electronics.

Next in line, Adano was the leading data converter for many years and is now focused on the industrial and communications markets.

Infineon is a well-known automotive electronics manufacturer and is ranked highly in power management and power semiconductors.

Sigma, on the other hand, is an analog manufacturer focused on RF, one of the RF chip giants, with major customers supplying consumer electronics manufacturers such as Apple, as well as communication equipment manufacturers.

NXP, ON Semiconductor, and Renesas are strong automotive electronics manufacturers, Mexico is more focused on the industrial sector, and Microchip Technology in the analog products outside the digital field of MCU is more biased.

Industry pattern “a super N strong”, outside the leading competition fragmentation. In the field of analog chips, Texas Instruments is the rightful leader, with a market share of 18%, and has been ranked first since 2004. And from the industry’s second to tenth place shares are only single digits, the share is relatively close.

The second place, Adano, overtook Infineon to become the second in the industry through the acquisition of Linear Tech, which has a similar product line, in 2017. As a result, competition in the analog chip industry is relatively fragmented, with a pattern of “one super (Texas Instruments)” and “N strong (Adenor, Infineon, STMicroelectronics, etc.)”.

In 1990, when Texas Instruments was not the leader in the analog chip industry, the industry was highly fragmented, with the number one company, National Semiconductor, having a market share of only 7%, a similar share to the rest of the top ten companies. However, by 2002, STMicroelectronics had jumped to the number one position and held more than 10 percent of the market, and from 2004 onwards, Texas Instruments began to hold on to the number one position, with a significant share.

At the same time, the lower-ranked companies gained greater market share through a steady stream of mergers and acquisitions. Important acquisitions include National Semiconductor by Texas Instruments (2011), Freescale’s separation from Motorola and eventual acquisition by NXP (2015), Fairchild Semiconductor by ON Semiconductor (2016), Intersil by Renesas (2016) and Linear Technology by ADENO (2017). As can be seen, over the past 30 years, the entire analog chip industry has continued to consolidate, with the market share of the leaders increasing and the industry moving towards concentration.