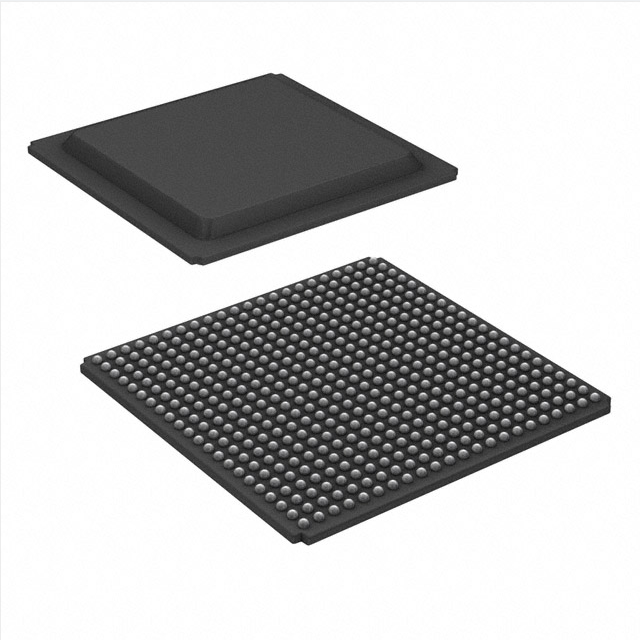

Electronic Components IC Chips Integrated Circuits XCZU7EV-2FFVC1156I IC SOC CORTEX-A53 1156FCBGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs) |

| Mfr | AMD Xilinx |

| Series | Zynq® UltraScale+™ MPSoC EV |

| Package | Tray |

| Standard Package | 1 |

| Product Status | Active |

| Architecture | MCU, FPGA |

| Core Processor | Quad ARM® Cortex®-A53 MPCore™ with CoreSight™, Dual ARM®Cortex™-R5 with CoreSight™, ARM Mali™-400 MP2 |

| Flash Size | - |

| RAM Size | 256KB |

| Peripherals | DMA, WDT |

| Connectivity | CANbus, EBI/EMI, Ethernet, I²C, MMC/SD/SDIO, SPI, UART/USART, USB OTG |

| Speed | 533MHz, 600MHz, 1.3GHz |

| Primary Attributes | Zynq®UltraScale+™ FPGA, 504K+ Logic Cells |

| Operating Temperature | -40°C ~ 100°C (TJ) |

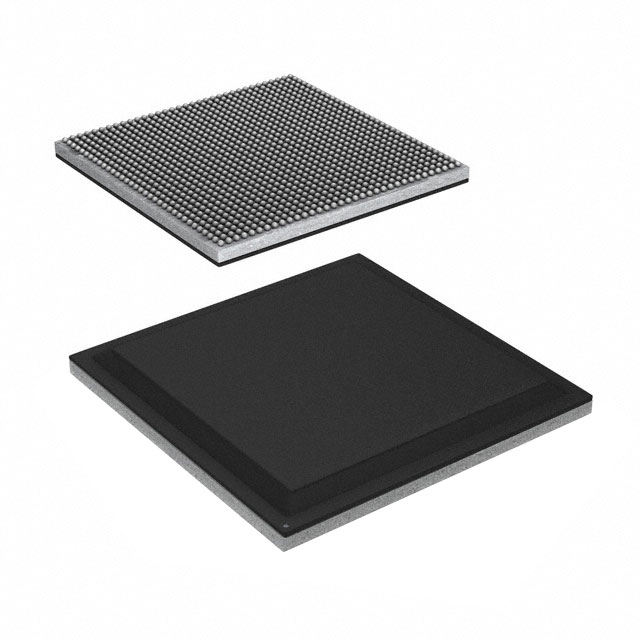

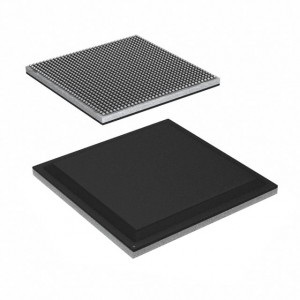

| Package / Case | 1156-BBGA, FCBGA |

| Supplier Device Package | 1156-FCBGA (35×35) |

| Number of I/O | 360 |

| Base Product Number | XCZU7 |

A $300 billion business: An era ends with AMD’s acquisition of Xilinx

The battle for high-performance computing has entered deep waters with the formal completion of a $300 billion acquisition in the semiconductor industry.

On February 14, AMD officially announced the completion of its acquisition of Xilinx. Since then, Xilinx’s official website has been replaced with AMD’s logo and financial information, and Xilinx has become part of AMD, and the two said they will jointly promote the development of high-performance and adaptive computing.

“The end of an era”, is the comment of many people in the semiconductor industry. After years of being the top independent FPGA (field-programmable gate array) company, Celeris was acquired by AMD’s old rival Intel, and with this acquisition, the two FPGA companies at the head of the pack have both become subsidiaries of major computing chip makers, bringing out the competitive implications of convergence.

Just one trading day before the acquisition was completed, the US technology stocks were affected by external factors and fell in general. The market considered that AMD’s acquisition of Xilinx did not cost any cash but used an all-stock transaction form, and the possible selling sentiment after this share swap led to a 10% drop in AMD’s share price on that day, becoming the leader among the leading chip companies.

However, after the official announcement of the completion of the acquisition, AMD’s share price rose again, showing that the market is bullish on the future development of the company under the competitive situation of the industry.

In the previous years of development, due to the founder’s background and development line differences, Intel has always been in the CPU innovation leadership, coupled with the GPU field Nvidia’s leading position, so AMD was crowned “the second oldest” title. Under the leadership of its current CEO, Mr. Zifeng Su, AMD has risen to prominence in recent years. With the acquisition of the industry’s first FPGA, AMD’s future path of CPU+GPU+FPGA convergence has attracted much attention as to whether it can escape this title.

But at the same time, it is worth noting that analysts have told reporters that Intel’s previous acquisition of Altera has not been able to reflect the relevant gains in its financial results for a longer period, which means that after the acquisition, it will still go through a process of constant friction.

.png)