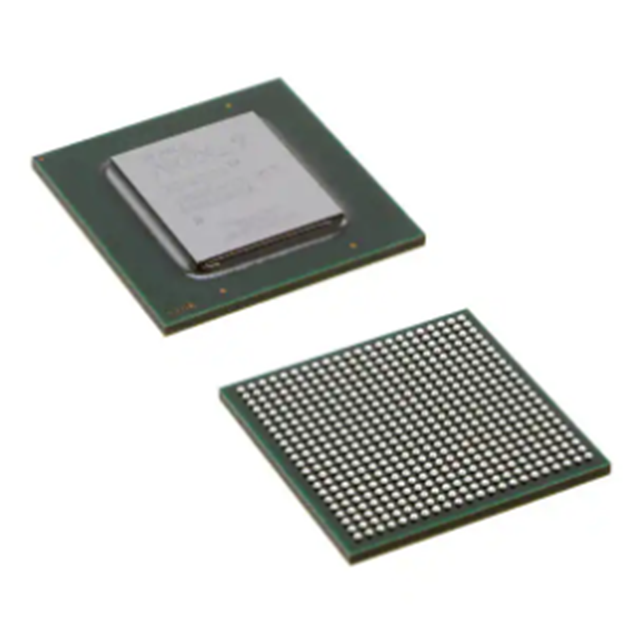

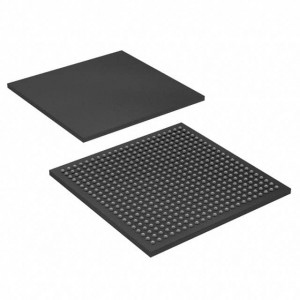

New and Original EP4CE30F23C8 Integrated circuit IC chips IC FPGA 328 I/O 484FBGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs) Embedded FPGAs (Field Programmable Gate Array) |

| Mfr | Intel |

| Series | Cyclone® IV E |

| Package | Tray |

| Standard Package | 60 |

| Product Status | Active |

| Number of LABs/CLBs | 1803 |

| Number of Logic Elements/Cells | 28848 |

| Total RAM Bits | 608256 |

| Number of I/O | 328 |

| Voltage – Supply | 1.15V ~ 1.25V |

| Mounting Type | Surface Mount |

| Operating Temperature | 0°C ~ 85°C (TJ) |

| Package / Case | 484-BGA |

| Supplier Device Package | 484-FBGA (23×23) |

| Base Product Number | EP4CE30 |

DMCA

In DCAI, Intel announced the roadmap for the next generation of Intel Xeon products to be released during 2022-2024.

According to technology, Intel will deliver Sapphire Rapids processors on Intel 7 in the first quarter of 2022; Emerald Rapids is scheduled to be available in 2023; Sierra Forest is based on the Intel 3 process and will offer high-density and ultra-high power efficiency, and Granite Rapids is based on the Intel 3 process and will be available in 2024. Granite Rapids will be upgraded to Intel 3 and will be available in 2024.

However, as reported by ComputerBase in June, at the Banc of America Securities Global Technology Conference, Sandra Rivera, general manager of Intel’s Data Center and Artificial Intelligence Business Unit, said that the Sapphire Rapids ramp-up did not go as planned and came later than Intel had expected. It is not known if the later process nodes will be affected by the Sapphire Rapids delay.

In February, Intel also announced a special “Falcon Shores” processor, dubbed the XPU, which Intel said would be based on the x86 Xeon processor platform (socket interface compatible) and incorporate Xe HPC GPUs for high-performance computing, with flexible core The XPU will be based on the x86 Xeon processor platform (socket interface compatible) while incorporating Xe HPC GPUs for high-performance computing, with flexible core counts, combined with next-generation packaging, memory and IO technologies to form a powerful “APU. In terms of the manufacturing process, Intel has indicated that Falcon Shores will use an email-level manufacturing process, and is expected to be available around 2024-2025.

Foundry

Intel has been particularly active in the foundry space since its IDM 2.0 strategy in 2021. This is evident from Intel’s successive cross-production plans.

In March 2021, Intel announced a US$20 billion investment in two new fabs in Arizona, the U.S. In September of the same year, construction began on the two chip plants, which are expected to be fully operational by 2024.

In May 2021, Intel announced a US$3.5 billion investment in a chip fab in New Mexico, USA, including the introduction of an advanced 3D packaging solution, Foveros, to upgrade the advanced packaging capabilities of the New Mexico packaging facility.

In January 2022, Intel announced the construction of two new chip factories in Ohio, USA, with an initial investment of over US$20 billion, which are expected to start construction this year and be operational by the end of 2025. In July this year, news broke that construction of Intel’s new Ohio fab had begun.

In February 2022, Intel and Israeli foundry major Tower Semiconductor announced an agreement whereby Intel would acquire Tower for $53 per share in cash, for a total enterprise value of approximately $5.4 billion.

In March 2022, Intel announced that it would invest up to €80 billion (US$88 billion) in Europe along the entire semiconductor value chain over the next decade, in areas ranging from chip development and manufacturing to advanced packaging technologies. The first phase of Intel’s investment plan includes a €17 billion investment in Germany to build an advanced semiconductor manufacturing facility; the creation of a new R&D and design center in France; and investments in R&D, manufacturing, and foundry services in Ireland, Italy, Poland, and Spain.

On 11 April 2022, Intel officially launched the expansion of its D1X facility in Oregon, USA, with a 270,000-square-foot expansion and US$3 billion investment, which will increase the size of the D1X facility by 20 percent when completed.

In addition to the bold expansion of the fab, Intel is also winning in the field of advanced processes.

Intel’s latest process map reveals that Intel will have five nodes of evolution in the next four years. Among them, Intel 4 is expected to be put into production in the second half of this year; Intel 3 is expected to be productized in 2023; Intel 20A and Intel 18A will be put into production in 2024. A few days ago, Song Jijiang, director of Intel China Research Institute, revealed at the China Computer Society Chip Conference that Intel 7 shipments this year have exceeded 35 million units, and Intel 18A and Intel 20A R&D have both made very good progress.

If Intel’s process can achieve the plan on schedule, it means Intel will be ahead of TSMC and Samsung at the 2nm node and be the first to go into production.

As for foundry customers, Intel announced a strategic cooperation with MediaTek not long ago. In addition, in a recent earnings meeting, Intel revealed that six of the world’s TOP 10 chip design companies are working with Intel.

The Accelerated Computing Systems and Graphics Division (AXG) business unit was established in June last year and specifically includes three sub-divisions: Visual Computing, Supercomputing, and Custom Computing Group. As a major growth engine for Intel, Pat Gelsinger expects the AXG division to bring in more than $10 billion in revenue by 2026. Intel will also ship more than 4 million discrete graphics cards by 2022.

On June 30, Raja Koduri, executive vice president of Intel’s AXG custom computing team, announced that Intel has today started delivering Intel Blockscale ASICs, a custom chip dedicated to mining, with cryptocurrency miners such as Argo, GRIID, and HIVE as the first customers. On July 30, Raja Koduri again mentioned on his Twitter account that AXG would have 4 new products coming out by the end of 2022.

Mobileye

Mobileye is another emerging business area for Intel, which spent $15.3 billion to acquire Mobileye in 2018. although it was once sung about, Mobileye achieved revenue of $460 million in the second quarter of this year, up 41% from $327 million in the same period last year, making it the biggest bright spot in Intel’s earnings report. The biggest highlight. It is understood that in the first half of this year, the actual number of EyeQ chips shipped was 16 million, but the actual demand for orders received was 37 million, and the number of undelivered orders continues to increase.

In December last year, Intel announced that Mobileye would go public independently in the US at a valuation of over $50 billion, with a planned timing of mid-year. However, Pat Gelsinger revealed during the second quarter earnings call that Intel will consider specific market conditions and push for a standalone listing for Mobileye later this year. Although it is unknown whether Mobileye will be able to support a market value of $50 billion by the time it goes public, it has to be said that Mobileye may also become a new pillar of Intel’s business, judging from the strong business growth momentum.

.png)