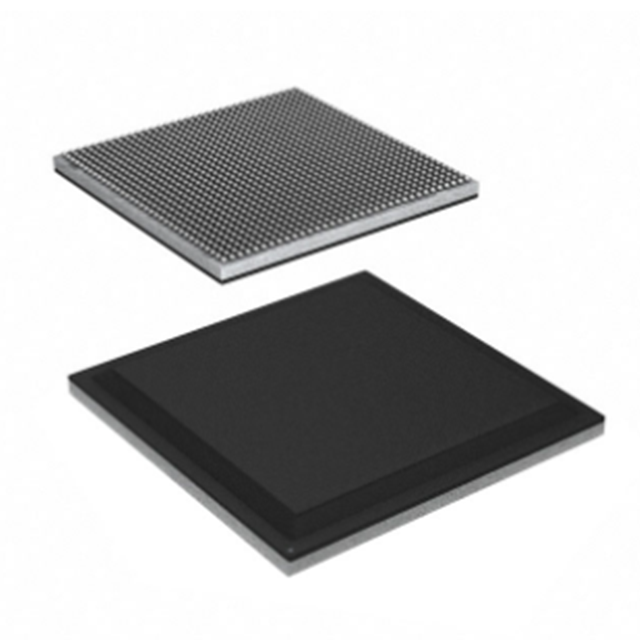

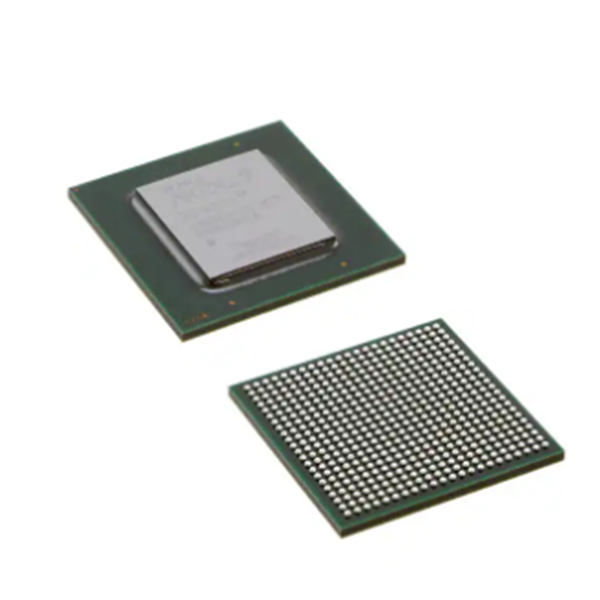

New And Original Integrated Circuit IC multiplexer BCM88650B1KFSBLG TRAFFIC MGR + PACKETPROC

Product Attributes

| TYPE | DESCRIPTION |

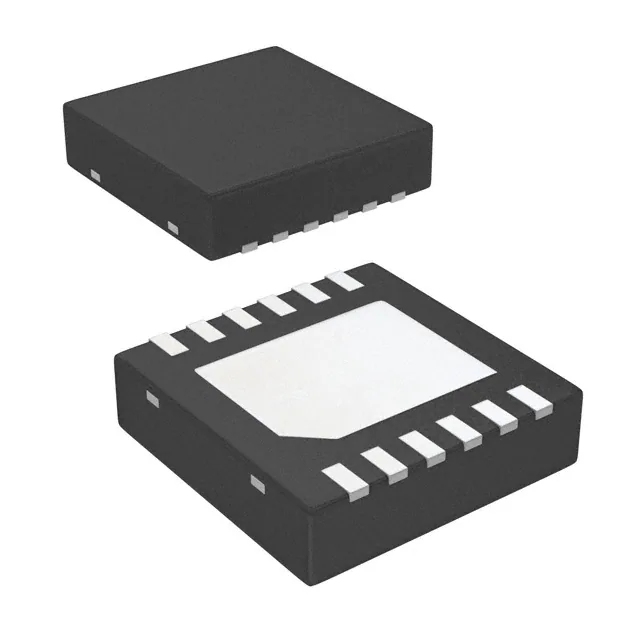

| Category | Integrated Circuits (ICs) Logic Signal Switches, Multiplexers, Decoders |

| Mfr | Broadcom Limited |

| Series | * |

| Package | Tray |

| Standard Package | 420 |

| Product Status | Active |

| Base Product Number | BCM88650 |

Broadcom

Broadcom Corporation (Nasdaq: BRCM) is the world’s leading semiconductor company for wired and wireless communications. Its products enable the delivery of voice, data, and multimedia to and within the home, office, and mobile environments. Broadcom offers the industry’s broadest range of best-in-class system-on-chip and software solutions for manufacturers of computing and networking devices, digital entertainment and broadband access products, and mobile devices.

In July 2018, Broadcom and enterprise software company CA Technologies announced that they had entered into an $18.9 billion cash acquisition agreement.

In 2019, it was named to the 2019 Forbes Global Digital Economy 100, ranking 30th.

History

On 6 November 2017, Broadcom proposed to acquire Qualcomm for $70 per share in cash plus stock ($60 in cash and $10 in stock) in a deal worth a total of $130 billion (equity + debt acquisition).

On 6 November 2017, Broadcom proposed to acquire Qualcomm for US$130 billion.

On 12 March 2018, Trump issued an order prohibiting Broadcom from acquiring Qualcomm as originally planned, citing national security.

On 14 March 2018, Broadcom announced that it had withdrawn and terminated its offer to acquire Qualcomm and also withdrew its nomination as an independent director at Qualcomm’s 2018 annual general meeting of shareholders.

On 11 July 2018, Broadcom and CA Technologies, an enterprise software company, announced that they had entered into an $18.9 billion cash acquisition agreement.

On 4 July 2019, Broadcom entered into advanced negotiations to acquire cybersecurity company Symantec for US$15 billion as it seeks to expand further into the more lucrative software business.

On December 13, 2019, chipmaker Broadcom (AVGO.US) released its fiscal fourth quarter and full-year fiscal 2019 financial results to the public. Before the release of the new earnings report, Broadcom’s share price performance was not a significant “drag”. Like other companies in the chip industry, Broadcom’s share price has soared, gaining about 16% in the past six months.

Broadcom is in talks to buy cloud computing company VMware as it seeks to further diversify its business into the enterprise software business, according to a media report on May 24, 2022.

On 26 May 2022 local time, US semiconductor giant Broadcom announced the acquisition of software company VMware for US$61 billion in cash and stock. the offer is well above VMware’s market value at the close of trading on 20 May, last Friday, but VMware shares have fallen nearly 50% since the high of over US$200 reached in spring 2019.

Late on May 26, Broadcom, the wireless communications giant, announced today that it has reached an agreement with VMware to acquire VMware, the cloud services and virtual machine major, for US$61 billion (approximately R410.2 billion).

Broadcom’s $61 billion deal to buy cloud software company VMware in June 2022 will face a lengthy antitrust review in Brussels due to regulators’ concerns that the deal could harm competition in the global technology industry.

Key markets

Cable/satellite set-top box solutions

Gigabit Ethernet

Server/storage networking

Wireless networks

Cable Modems

Digital TV Solutions

Mobile Communications

Enterprise Switching

DSL

Broadband Processors

Voice over IP (VoIP)

Network Infrastructure

Digital TV

Bluetooth

GPS