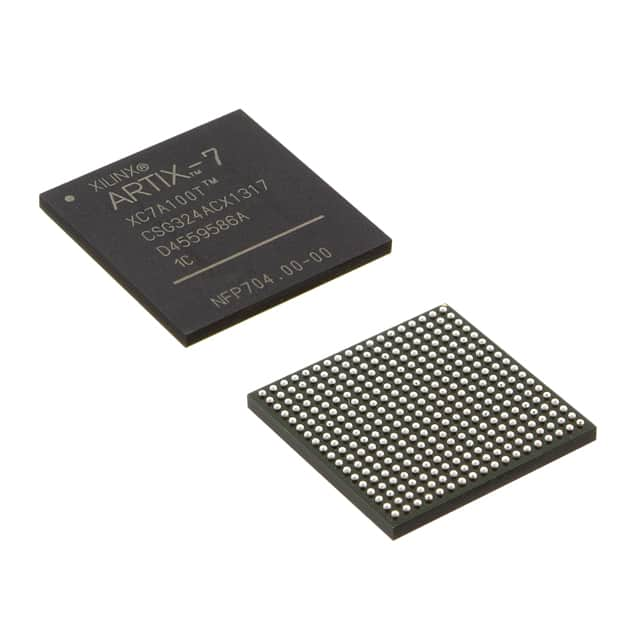

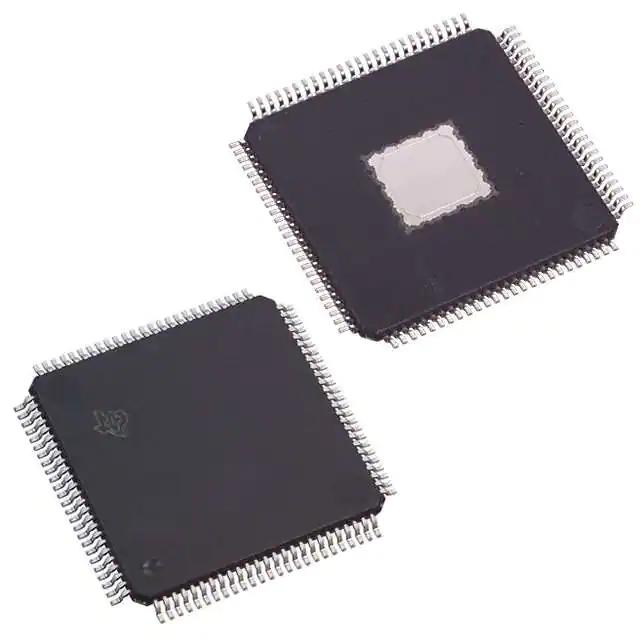

XC7A35T-2CSG324C 324-CSPBGA (15×15) integrated circuit IC FPGA 210 I/O 324CSBGA Inventory Spot Ic Chip

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)Embedded |

| Mfr | AMD Xilinx |

| Series | Artix-7 |

| Package | Tray |

| Standard Package | 126 |

| Product Status | Active |

| Number of LABs/CLBs | 2600 |

| Number of Logic Elements/Cells | 33280 |

| Total RAM Bits | 1843200 |

| Number of I/O | 210 |

| Voltage – Supply | 0.95V ~ 1.05V |

| Mounting Type | Surface Mount |

| Operating Temperature | 0°C ~ 85°C (TJ) |

| Package / Case | 324-LFBGA, CSPBGA |

| Supplier Device Package | 324-CSPBGA (15×15) |

| Base Product Number | XC7A35 |

The data center-first strategy is the first time that Xilinx has explicitly identified an application area as a core strategy for the company, especially since this strategy was “tit-for-tat” after its biggest competitor, Altera, was acquired by Intel, the leader in the server ecosystem, and as the rest of Altera’s product line faded away after the acquisition, Xilinx’s presence in the data center became more and more important. Victor’s report card shows that Xilinx’ data center revenue has tripled in the past three years, and he says that data center deployments are still in the early stages and there is still plenty of room for Xilinx to expand, especially with the creation of the FaaS (FPGA as a service) model. service) the model was born, the development of FPGA as a service business model, which is now widely used on AWS and Azure.

In terms of core market development strategy, Victor Peng summed up the company’s achievements by saying that apart from launching new products in the traditional communication market and achieving rapid growth in RFSoC and O-RAN, the other core markets of Xilinx have maintained a very high double-digit growth rate in the past three years. In the automotive sector, which grew 22%, the cumulative number of automotive-grade devices shipped for ADAS has now exceeded 80 million, and in the fiscal year just ended Xilinx achieved record growth rates in industrial vision, medical, and research, as well as near record growth in aerospace.

Talking about his feelings and challenges in leading Xilinx forward in the past three years, Victor Peng first lamented that various external variables were the most difficult challenges, such as the trade war and the new crown epidemic. In the face of these challenges, he and Xilinx management have adopted effective response plans, including educating new potential customers about adaptive computing capabilities, developing and deploying software stacks that do not require chip design experience, and developing an ecosystem.

On behalf of the management team, he summarised the key decisions made over the years in three points.

- Creating more value for our customers by solving important current and future challenges.

- Working to make adaptive computing more empowering for more innovators by making our platform easier to use.

- Build a culture for Xilinx that enables both individual employees and teams to grow in tandem.

As the CEO of an acquired company, it is not easy to evaluate Victor Peng’s achievements over the past three years, but apart from the above glowing Celeris report card, there are a few details about the acquisition that you can savor, one is that Celeris will have two board members joining the AMD board, thus ensuring the continuity of Celeris’ business operations in the future. The second is that the price for the acquisition of Xilinx is US$35 billion, which is more than twice the price of Intel’s acquisition of Altera (Intel delayed the deal for more than a month and let the price rise from 130 to 167, so I think Intel lost money).